School fees are skyrocketing, inflation is peaking and the rupee is sliding. Today, a single health crisis can push a family’s finances back by five years. As parents, we face a double challenge. We must protect our families today while investing smartly enough to outpace rising costs.

If you have a daughter, you are likely aware of the Government’s Sukanya Samriddhi Yojana (SSY). Part of the Beti Bachao Beti Padhao initiative started back in 2015. It currently offers a solid 8.2 % p.a. guaranteed return. It is a fantastic tool and I wish and hope that government should launch a similar tool for male child as well.

However, we must ask the tough question: Is 8.2% enough?

With education inflation hitting double digits and the cost of foreign studies rising, will this guarantee be sufficient for a premium degree or a medical emergency? If your answer is “No,” it’s time to compare this safety net Sukanya Samriddhi Yojana (SSY) with the growth potential of Equity Mutual Funds.

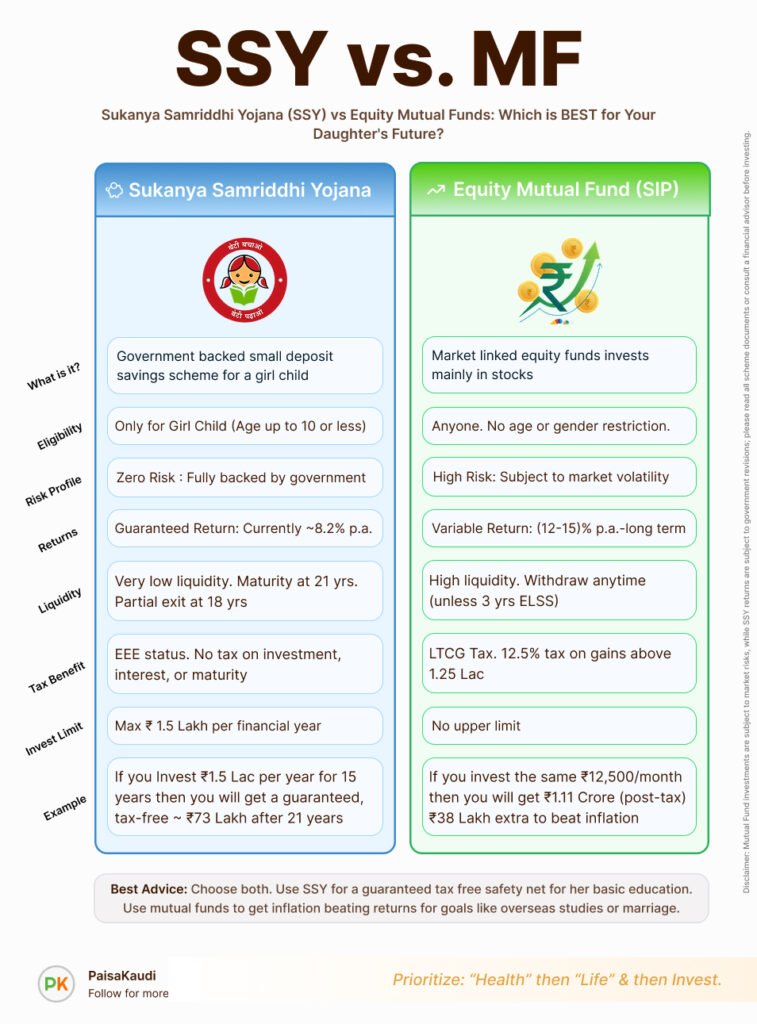

Sukanya Samriddhi Yojana vs Equity Mutual Funds

| Features | Sukanya Samriddhi Yojana (SSY) | Equity Mutual Fund (SIP) |

| What is it? | Government backed small deposit savings scheme for a girl child | Market linked equity funds invests mainly in stocks |

| Eligibility | Only for Girl Child (Age up to 10 or less) | Anyone. No age or gender restriction. |

| Risk Profile | Zero Risk : Fully backed by government | High Risk: Subject to market volatility |

| Returns | Guaranteed Return: Currently ~8.2% p.a. | Variable Return: (12-15)% p.a.-long term |

| Liquidity | Very low liquidity. Maturity at 21 yrs. Partial exit at 18 yrs | High liquidity. Withdraw anytime (unless 3 yrs ELSS) |

| Tax Benefit | EEE status. No tax on investment, interest, or maturity | LTCG Tax. 12.5% tax on gains above 1.25 Lac |

| Invest Limit | Max ₹ 1.5 Lakh per financial year | No upper limit |

| Example | If you Invest ₹1.5 Lac per year for 15 years then you will get a guaranteed, tax-free ~ ₹73 Lakh after 21 years | If you invest the same ₹12,500/month then you will get ₹1.11 Crore (post-tax). ₹38 Lakh extra to beat inflation |

Best Advice:

- Choose both. Use SSY for a guaranteed tax free safety net for her basic education.

- Use mutual funds to get inflation beating returns for goals like overseas studies or marriage.

What has been your experience with these investments? Write your thoughts in the comment box below, and I will get back to you!

Disclaimer: Mutual Fund investments are subject to market risks, while SSY returns are subject to government revisions; please read all scheme documents or consult a financial advisor before investing.