Back in our school days, before we had any idea about insurance or investments, the only name we knew was LIC. Back then, savings simply meant LIC. It was a good thing because awareness was low, and people feared losing their money. LIC was, and still is, a trustworthy and strong brand.

But now, we live in an era where we have specialized options. You can choose tools to protect your dependent family members and separate tools to grow your money for future goals and retirement. so first let’s understand the endowment plan.

List of Topic Covered

What are Endowment Plans?

Endowment plans are life insurance policies that try to give you protection (insurance) + savings at the same time.

The Catch: Because they try to solve both the purpose at a time, a part of your premium goes to insurance and the rest to savings. This usually results in a very low death cover and a low IRR (Internal Rate of Return), typically between 4% to 6.5%. This neither fully protects your family nor grows your capital enough to beat inflation.

How IRR Works : IRR is the actual annual interest rate your investment earns over time.

Let’s understand this with the help of an example:

If you invest ₹1 Lakh every year for 10 years and receive ₹15 Lakhs at the end, your money didn’t just grow by a flat amount. The IRR is 7.2%, meaning your money effectively grew by 7.2% every single year.

The Reality Check: Top 4 Endowment Plans

Let’s assume a 30 years old healthy male invests ₹1 Lakh/year for 10 years with a 20 year maturity. So policy term (PT) is 20 years and premium paying term (PPT) is 10 years.

| Plan Name | Total Invested in 10 years (with GST) | Maturity (Year 20) | Estimated IRR |

| LIC New Endowment Plan | ~ ₹10.25 Lakh | ~ ₹19.50 Lakh | ~ 5.1% – 5.5% |

| HDFC Life Sanchay Plus | ~ ₹10.25 Lakh | ~ ₹25.77 Lakh | ~ 6.44% |

| ICICI Pru Savings Suraksha | ~ ₹10.25 Lakh | ~ ₹22.50 Lakh | ~ 5.8% – 6.2% |

| Max Life Guaranteed Income | ~ ₹10.25 Lakh | ~ ₹24.80 Lakh | ~ 6.1% – 6.4% |

So the traditional plans usually offer ~ 5% – 6.5%. While this is tax-free under Section 10(10D), it struggles to beat education inflation, which hits double digits.

Top 4 Term Insurance Plans (1 Crore Cover)

We are taking a profile of a 30 years old, non-smoking male (approximate annual premiums for 2025):

| Insurer | Plan Name | Annual Premium (incl. GST) |

| HDFC Life | Click 2 Protect Supreme | ~ ₹12,000 |

| ICICI Pru Life | iProtect Smart | ~ ₹11,500 |

| Tata AIA Life | Sampoorna Raksha Promise | ~ ₹10,500 |

| Axis Max Life | Smart Secure Plus | ~ ₹11,800 |

The surplus money: With the total budget of ₹1,00,000 if you deduct cost of the Term plan which is ₹12,000, you have ₹88,000 per year (or ₹7,333 / month) to invest in Mutual Funds or any other tool where you can get more than ~ 6 % returns. Since I am comparing Endowment vs MF, I will talk about Mutual Fund only.

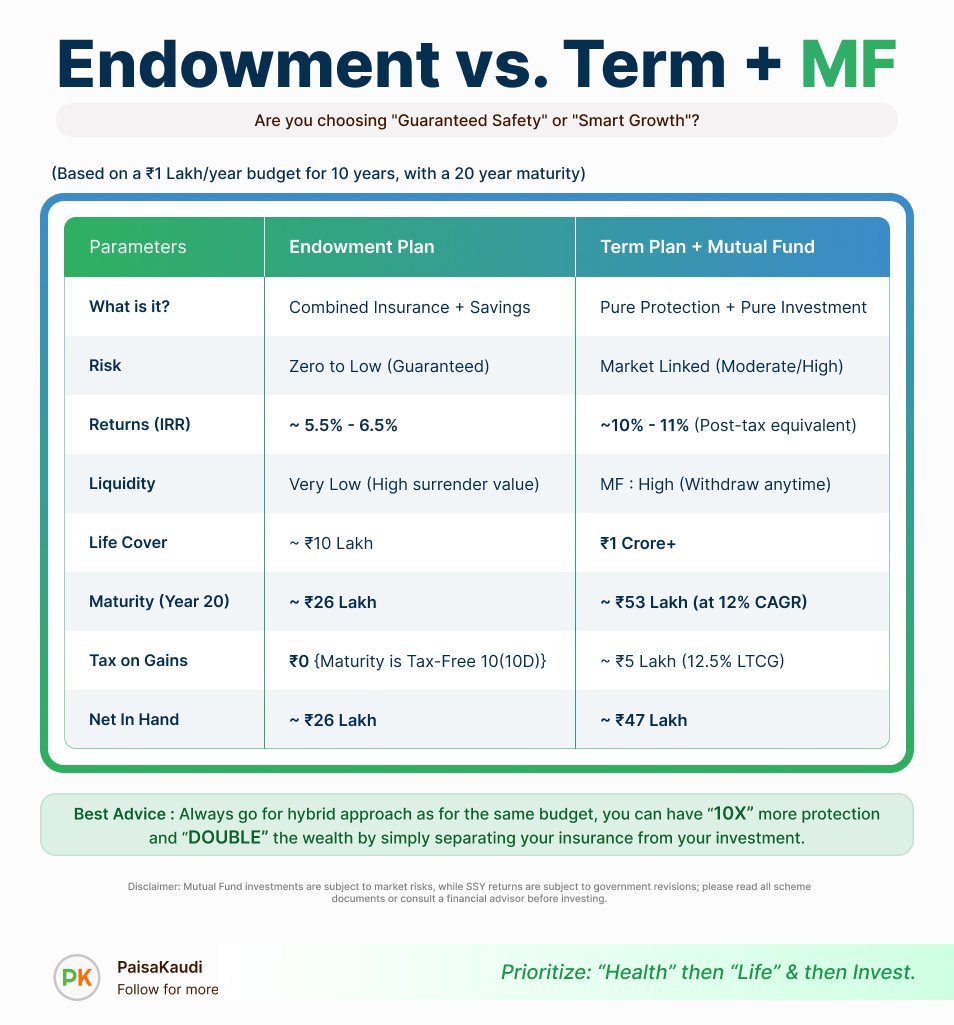

Now let’s compare,

Endowment plan with the Hybrid strategy (Term + Mutual Fund)

Verdict

- Endowment Plans: Provide comfort but fail to beat education inflation (10-12%). Your money technically loses purchasing power over time.

- The Hybrid Strategy: Buying a Term Plan for protection and a Mutual Fund for growth gives you a massive ₹1 Crore safety net and nearly ₹22 Lakh extra in wealth.

I have started this series to compare Mutual Funds with various market tools.

Would you rather have a “Guaranteed” ₹25 Lakh or a “Strategic” ₹47 Lakh with 10x more security? Write your thoughts in the comment box below and let’s discuss!