You’ve likely heard elderly folks complain, “हमारी वृद्धा पेंशन नहीं आई,” or the famous dialogue from retired government workers: “जी रहे हैं पेंशन पे।” Pensions were once seen as a perk of government jobs, but since 2009, anyone can open an NPS account with flexible voluntary contributions and no upper limit. New PFRDA rules are making NPS hugely popular in India.

List of Topic Covered

What is the NPS Scheme (NPS 2.0)?

NPS is a government-backed, voluntary retirement tool regulated by the PFRDA. It is designed to build a retirement corpus through market-linked growth.

Key features of NPS 2.0

- 100% Equity Exposure: Under the new Multiple Scheme Framework (MSF), you can now invest 100% of your money in Equities (Asset Class E).

- 80% Lump Sum Exit: For a corpus above ₹12 Lakh, you can now withdraw 80% as a lump sum (up from 60%). Only 20% must be used for a pension (annuity).

- Full Cash for Small Savings: If your total corpus is ₹8 Lakh or less, you can withdraw the full 100% as cash.

- Average Returns: Over the last 10 years, NPS Scheme E (Equity) has delivered an average return of ~13% – 15% (varies by fund manager).

- Systematic Unit Redemption (SUR) : Just like a Mutual Fund’s SWP, NPS now offers SUR. You can redeem units periodically.

- Different Asset Classes: You can decide the proportion of equity (E), corporate debt (C), government securities (G), and alternative assets (A)

What are Mutual Funds?

Mutual Funds are SEBI-regulated investment vehicles that pool money to invest in stocks and bonds. They are built for wealth creation with maximum freedom.

Key features of NPS 2.0

- Total Liquidity: Unlike NPS (locked until 60), you can withdraw Mutual Fund units anytime.

- Average Returns: Historically, Diversified Equity Mutual Funds have delivered ~12% – 17% over the long term, depending on the category (Large, Mid, or Small Cap).

- SWP Facility: You can create your own tax-efficient pension using a Systematic Withdrawal Plan.

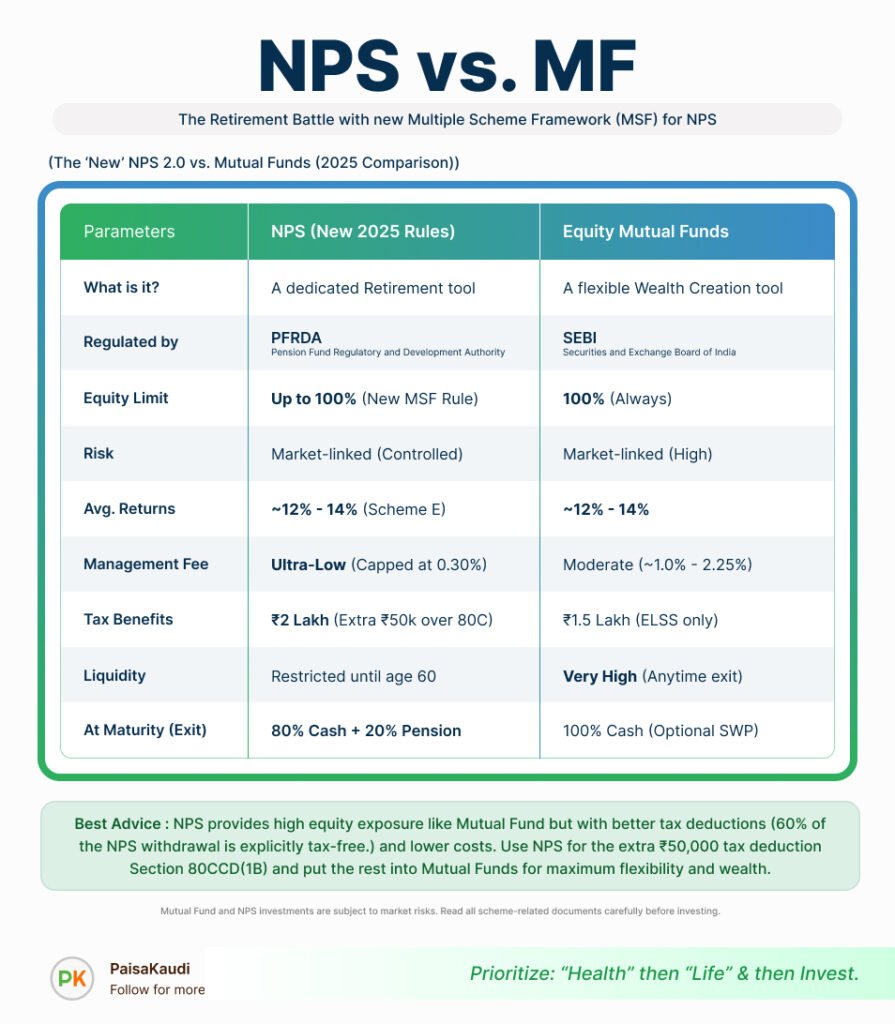

NPS Vs Mutual Funds Comparison 2026

NPS Vs Mutual Funds Example 2026

Now let’s understand this battle with the real life example.

- Scenario: 30-year-old Rahul and Yogesh earning ₹30 LPA, investing ₹20,000/month for 25 years. Rahul invests in NPS while Yogesh invests in Mutual Funds.

| Parameters | NPS 2.0 (100% Equity) | Equity Mutual Funds |

| Projected Market Return | ~ 12.0% | ~ 12.0% |

| Expense Ratio (Fees) | ~ 0.3% | ~ 1.5% |

| Net Return to You | 11.7% | 10.5% |

| Total Invested | ₹60,00,000 | ₹60,00,000 |

| Total Corpus at Maturity | ₹3.29 Crore | ₹2.61 Crore |

| Maturity Rule | 80% Cash + 20% Annuity | 100% Cash Withdrawal |

| Taxable Amount | ₹65.8 Lakh (Extra 20% lump sum) | ₹2.00 Crore (Gains > ₹1.25L) |

| Tax Deducted | ~ ₹19.7 Lakh (at 30% slab) | ~ ₹25.0 Lakh (at 12.5% LTCG) |

| Net Cash in Bank | ₹2.43 Crore | ₹2.36 Crore |

| Locked for Pension | ₹65.8 Lakh (Monthly Income) | ₹0 (No locking) |

For fare calculations we have taken 12% market growth. In this scenario, NPS 2.0 ultra-low fees create a higher total corpus and slightly more initial cash, plus a monthly pension too. However, Mutual Funds offer ₹2.36 Crore with total flexibility and a simpler tax structure, free from mandatory pension ties. So NPS is net net the winner against Mutual Funds, if retirement is the goal.

I have started this series to compare Mutual Funds with various market tools. Which tool you will prefer or suggest to anyone for retirement? Write your thoughts in the comment box below and let’s discuss!